You've built a £30,000 portfolio of dividend stocks in a General Investment Account (GIA). It feels modest—certainly not the kind of portfolio that should trigger tax complications. You assume the dividend income is too small to worry about. After all, you're not drawing a full-time income from it. It's just a few hundred quid in dividends each quarter.

But here's the reality most investors discover too late: at a typical 3.5% yield, that £30,000 portfolio already breaches your entire annual dividend allowance. And if you're a higher rate taxpayer, you owe HMRC nearly £200 every single year—whether you knew about it or not. This isn't a tax planning issue for the wealthy. It's a trap that catches ordinary dividend investors who simply didn't know the rules had changed.

What Is the Dividend Allowance, and Why Does It Matter?

The UK dividend allowance is the amount of dividend income you can receive from investments held outside an ISA (in a GIA) before HMRC starts taxing you. It's a tax-free threshold, and once you breach it, every pound above the allowance gets taxed at your income tax band rate.

As of the 2024-25 tax year onwards, that allowance is £500. Not £500 per month. £500 for the entire tax year.

To understand how restrictive that is, consider what £500 in annual dividends actually represents. If your GIA portfolio yields 3.5%—roughly the long-term average for FTSE 100 stocks—then £500 in dividends comes from a portfolio worth just £14,286. At a 4% yield, the breakeven point drops to £12,500.

| Yield | Portfolio Value That Generates £500 | Annual Dividends |

|---|---|---|

| 3.0% | £16,667 | £500 |

| 3.5% | £14,286 | £500 |

| 4.0% | £12,500 | £500 |

| 4.5% | £11,111 | £500 |

Most dividend investors with GIA holdings over £12,500–£16,700 (depending on yield) are already breaching the allowance without realising it. And once you're over, HMRC taxes you on the excess—at rates that vary sharply depending on your income.

The Tax Rates You're Paying Once You Breach

When your GIA dividends exceed £500 in a tax year, the amount above that threshold is taxable at your income tax band rate. These are the current rates for the 2025-26 tax year:

- Basic rate taxpayers (income £12,571–£50,270): 8.75% on dividend income

- Higher rate taxpayers (income £50,271–£125,140): 33.75% on dividend income

- Additional rate taxpayers (income over £125,140): 39.35% on dividend income

And here's the kicker: from April 6, 2026, those rates are going up:

- Basic rate: 8.75% → 10.75% (+2 percentage points)

- Higher rate: 33.75% → 35.75% (+2 percentage points)

- Additional rate: 39.35% → 39.35% (unchanged)

Let's make this concrete with a worked example. Say you have that £30,000 GIA portfolio yielding 3.5%. Your annual dividends are £1,050. The first £500 is tax-free. The remaining £550 is taxable.

Tax owed by income band (current 2025-26 rates):

- Basic rate taxpayer: £550 × 8.75% = £48.13

- Higher rate taxpayer: £550 × 33.75% = £185.63

- Additional rate taxpayer: £550 × 39.35% = £216.43

From April 2026, those figures rise:

- Basic rate taxpayer: £550 × 10.75% = £59.13 (increase of £11/year)

- Higher rate taxpayer: £550 × 35.75% = £196.63 (increase of £11/year)

- Additional rate taxpayer: £550 × 39.35% = £216.43 (no change)

The same portfolio, the same dividends—but a higher rate taxpayer pays four times what a basic rate taxpayer pays. And the rate increases from April mean that gap is widening further.

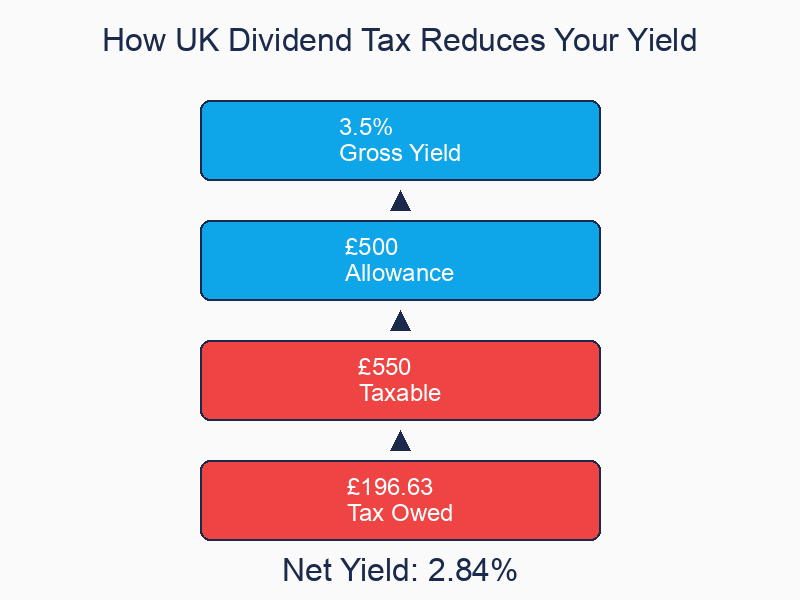

How This Affects Your Real Yield

Here's the question most investors never ask: What's my effective yield after UK dividend tax?

Your broker shows you a 3.5% yield. But if you're a higher rate taxpayer breaching the allowance, you're not keeping 3.5%. You're receiving £1,050 in gross dividends, paying £196.63 in dividend tax (from April 2026), and netting £853.37 annually. On a £30,000 investment, that's an effective yield of 2.84%.

Your "3.5% yield" is really 2.84% after tax. That's the difference between a comfortable weekend away and a cancelled trip—every year, forever, unless you move those holdings into an ISA.

And if you're holding US stocks in that GIA, the picture gets even worse.

The Double Tax Hit on Foreign Stocks in Your GIA

Most UK investors know about US withholding tax—the 15% the IRS takes before your dividend even leaves the United States. We covered this in detail in Episode S1E01. But here's the part that catches people off guard:

When you hold US stocks in a GIA, HMRC taxes you on the gross dividend amount—before the US took their slice.

Let's walk through what happens with a US dividend stock in your GIA:

- US company declares a quarterly dividend

- The IRS withholds 15% immediately (if you've filed a W-8BEN)

- You receive 85% of the dividend

- HMRC calculates your UK dividend tax on the full 100%—the amount before US withholding

- Your £500 allowance is measured against the gross amount, not what you actually received

So the money you never even saw still eats into your £500 allowance.

You can claim Double Taxation Relief to offset some of the US tax against your UK bill, but the credit is capped at your UK tax rate on that income. If you're a basic rate taxpayer, you won't recover all of it. And critically, the gross dividend still counts toward your allowance—so the US withholding tax accelerates how quickly you breach the £500 threshold.

Worked example: US stock at 4% gross yield in a GIA

- Gross dividend: 4.0%

- After US withholding tax (15%): You receive 3.4%

- UK dividend tax (higher rate, 33.75% on gross): 1.35%

- Less Double Taxation Relief (0.6% offset): Net UK tax ~0.75%

- Total deductions: 0.6% (WHT) + 0.75% (UK tax) = 1.35%

- Effective yield: 2.65%

You started with a 4% advertised yield. After both the US and UK governments take their share, you're keeping 2.65%. That's a 34% reduction from the headline figure.

In an ISA, you'd still lose the 15% US withholding tax (ISAs don't protect you from foreign tax), but you wouldn't owe the UK dividend tax on top. In a GIA, you're getting hit from both sides.

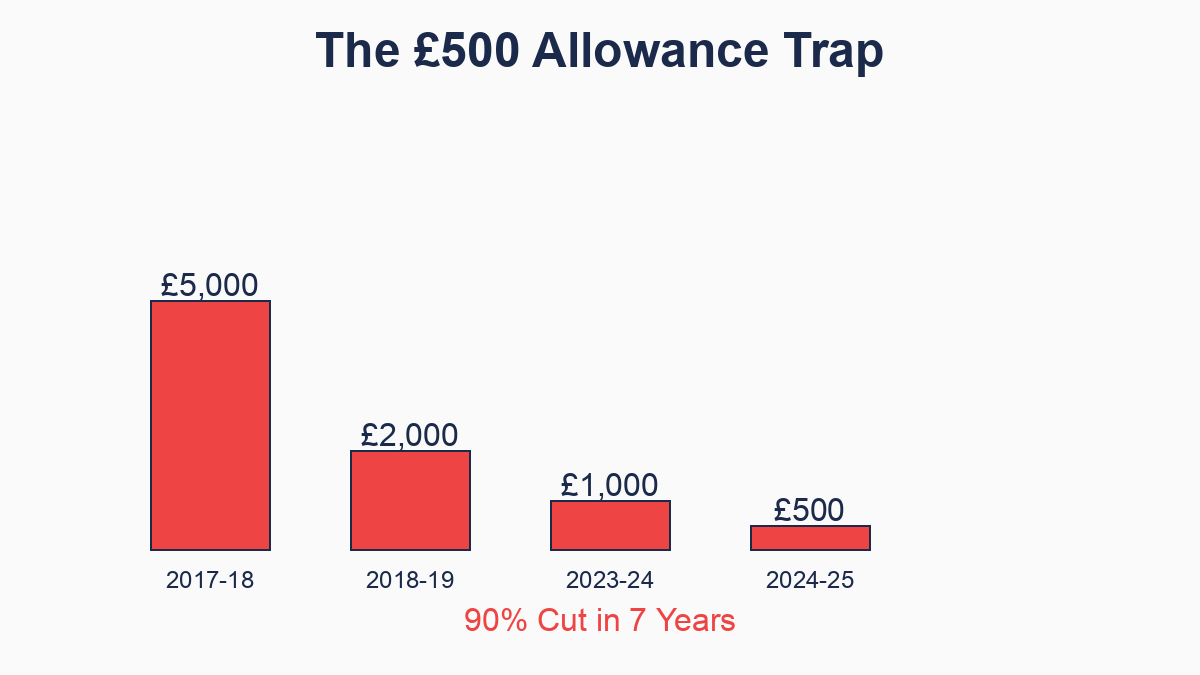

How We Got Here—The 90% Allowance Cut

It didn't used to be this tight. Back in the 2017-18 tax year, the dividend allowance was £5,000. At a 3.4% yield, that covered a GIA portfolio worth up to £147,000. Most investors never came close to breaching it.

Then the government started squeezing.

| Tax Year | Allowance | Change from Previous |

|---|---|---|

| 2017-18 | £5,000 | Initial allowance |

| 2018-19 to 2022-23 | £2,000 | -60% cut |

| 2023-24 | £1,000 | -50% cut |

| 2024-25 onwards | £500 | -50% cut |

From £5,000 to £500 in seven years. That's a 90% reduction. What used to protect a six-figure portfolio now barely covers £15,000.

This isn't an accident. It's deliberate fiscal policy. The government has systematically tightened the dividend allowance to draw more investors into the tax net, and most people didn't notice until they were already caught.

The Filing Trap—When You're Required to Submit a Self-Assessment Return

Here's another detail that catches investors off guard: if your dividend income exceeds £10,000 in a tax year, you're legally required to file a Self-Assessment return—even if you don't usually file one.

For a 3.5% yield portfolio, that's a GIA worth £285,714. Not as rare as you might think for investors who've been building their portfolios for years. And if you miss the filing deadline or fail to report it, HMRC can issue penalties and interest charges.

The £500 allowance isn't just a tax issue—it's an administrative burden. You're required to track your GIA dividends, separate them from your ISA dividends (which don't count), calculate the tax owed, and report it to HMRC. Your broker isn't going to send you a notification saying "you've breached your allowance." That's your responsibility.

HMRC Enforcement Is Getting Smarter

If you're thinking "I'm only a bit over the allowance, HMRC won't notice"—think again.

From the 2026 tax year onwards, HMRC is deploying an AI-powered compliance system that unifies data from multiple sources: banking, property transactions, crypto exchanges, and investment platforms. It creates a more complete financial picture of each taxpayer and flags discrepancies automatically.

Translation: if your GIA is generating £800 in dividends and you're not reporting it, HMRC is far more likely to catch it now than they were five years ago.

The £500 allowance is no longer a "nice to know" planning detail. It's an enforcement concern.

ISA vs GIA—Where Your Dividends Should Live

The obvious question: why not just hold everything in an ISA and avoid this mess?

ISA advantages:

- Dividends are completely tax-free and don't count toward the £500 allowance

- No Capital Gains Tax on disposal

- No reporting obligations to HMRC

- Full tax shelter for UK dividends

ISA disadvantages:

- Annual contribution limit of £20,000 (for the 2025-26 tax year)

- Cannot transfer existing GIA holdings "in specie" (must sell and rebuy, triggering CGT)

- Takes years to move a large GIA portfolio into ISA wrapper

GIA advantages:

- Unlimited annual contributions

- Flexibility for portfolios exceeding the ISA contribution limit

GIA disadvantages:

- Dividends above £500 taxed at 8.75–39.35% (soon 10.75–39.35%)

- Must file Self-Assessment if dividends exceed £10,000

- Subject to Capital Gains Tax on disposal

For most dividend investors, ISA placement is clearly better—but the £20,000 annual contribution limit means it takes time to migrate a large GIA portfolio. If you've got £100,000 in a GIA, it'll take five years of maxing out your ISA allowance to fully shift those holdings. During that transition, you're still paying GIA dividend tax on whatever remains outside the ISA.

The earlier you start that migration, the less you'll pay in cumulative tax over the next decade.

How Much Is This Costing You at Scale?

Let's scale this up. Say you've built a £100,000 GIA portfolio yielding 3.5%—a mix of UK and international dividend stocks. Your annual dividends are £3,500. After the £500 allowance, you've got £3,000 of taxable dividend income.

Tax owed (2025-26 rates):

- Basic rate taxpayer: £3,000 × 8.75% = £262.50

- Higher rate taxpayer: £3,000 × 33.75% = £1,012.50

- Additional rate taxpayer: £3,000 × 39.35% = £1,180.50

Tax owed (from April 2026):

- Basic rate taxpayer: £3,000 × 10.75% = £322.50 (increase of £60/year)

- Higher rate taxpayer: £3,000 × 35.75% = £1,072.50 (increase of £60/year)

- Additional rate taxpayer: £3,000 × 39.35% = £1,180.50 (no change)

For a higher rate taxpayer, that's £1,072.50 every year. Over five years, that's £5,362.50 in dividend tax—money that could have been reinvested, compounding your returns, growing your portfolio. Instead, it's simply gone.

And remember: this is on top of any US withholding tax you're already losing on foreign holdings (which we covered in the previous episode). If 40% of your £100,000 portfolio is US stocks, you're losing roughly £300/year to withholding tax, plus £1,072.50 to UK dividend tax. That's £1,372.50 per year in combined tax leakage—enough to fund an additional £40,000 worth of ISA contributions over five years if you'd moved those holdings into tax-sheltered wrappers earlier.

The opportunity cost of staying in a GIA when you could be in an ISA compounds against you every year. The sooner you start migrating, the less you lose.

How to Track Where You Stand

The core problem is visibility. Your broker isn't tracking your dividend allowance for you. They'll show you the dividends you've received, but they won't separate ISA dividends (which don't count) from GIA dividends (which do). They won't calculate how much you owe or flag when you've breached the threshold.

Most investors discover they're over the allowance when they're scrambling to fill in their Self-Assessment return in January—nine months after the tax year ended, when it's far too late to do anything about it.

Nestor's dividend allowance tracker shows you exactly where you stand. Import your Trading212 CSV files, and the Insights tab separates your ISA dividends from your GIA dividends automatically. You see how much of your £500 allowance you've used in the current tax year—updated in real time as dividends arrive.

And based on your income band (which you set once in the app), Nestor calculates exactly how much dividend tax you owe for the current tax year. No guessing. No spreadsheets. No manual tracking of which dividends came from which wrapper.

If you've breached the allowance, you know the number before HMRC does.

The One Thing to Remember

£500 sounds like a cushion until you do the maths on your own GIA.

For most dividend investors, a portfolio over £12,500–£16,700 (depending on yield) is already breaching the allowance. Once you're over, you owe tax—and possibly a filing obligation—whether you knew about it or not. The number that matters isn't what your broker shows you as a headline yield. It's what you're actually keeping after HMRC takes their share.

The dividend allowance didn't just shrink—it collapsed by 90% in seven years. And the tax rates are climbing from April 2026. The investors who come out ahead are the ones tracking their exposure now, moving holdings into ISAs strategically, and calculating what they actually keep instead of what the label says.

Track your allowance, or it'll track you.